Podcast: Play in new window | Download

MAJOR CHANGES COMING TO PENSACOLA REAL ESTATE CLOSINGS AUG 1, 2015

If you haven’t heard by now, a MAJOR portion of the Dodd Frank act goes into effect on Aug 1, 2015. This portion is under the control of the Consumer Federal Protection Bureau. I know I know some of you are wondering what that has to do with me? EVERYTHING. This will affect most residential loans in the U.S. Eventually I believe we will get used to the new forms and updates, but it still will be a longer time frame to sell a piece of real estate. (Unless your buyer is cash you can forget those 3 week closings). In this episode i bring in Attorney Mark H. Taupeka, to discuss some of the history and what is to come.

If you haven’t heard by now, a MAJOR portion of the Dodd Frank act goes into effect on Aug 1, 2015. This portion is under the control of the Consumer Federal Protection Bureau. I know I know some of you are wondering what that has to do with me? EVERYTHING. This will affect most residential loans in the U.S. Eventually I believe we will get used to the new forms and updates, but it still will be a longer time frame to sell a piece of real estate. (Unless your buyer is cash you can forget those 3 week closings). In this episode i bring in Attorney Mark H. Taupeka, to discuss some of the history and what is to come.

01:28 Mark H. Taupeka 251-301-1000 office marktaupeka@southalabamalawyers.com

02:49 Where did all this come from. Was it the mortgage crash? Are we better protected?

05:17 DODD FRANK Act and the forming of the Consumer Financial Protection Bureau

10:20 The lenders are now responsible for SOOO much more

13:27 Even the title agencies have less responsibilities

16:00 EXPECT Delays. Its like flying around Christmas. The 30 day closing is probably a thing of the past, and the new norm will be 45-60- days to close a loan.

New Closing forms

UPDATE!!

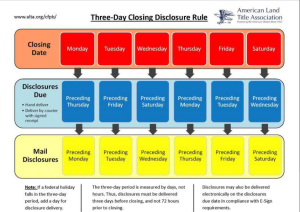

We now can confirm that effects all qualified mortgage loans when application has been taken on or after Aug 1, 2015